The CDK token

has landed!

Join the CDK army to bring AI, decentralisation and tokenization to the world of mobility.

Private sale Round 2 is live!

Price of $ 0.0025 per 1 CDK Token

What is CDK?

The CDK token will power the web3 side of the codenekt

plateform, data encryption, nft transactions fees on the

Avalanche blockchain, drivers incentives and rewards, stacking

pools and it will also give access to third party mobility deals

among other benefits.

TRACEABILITY

Leveraging AI algorythms and NFTs to make the mobility supply chain as transparent as possible.

integrity

Leveraging blockchain and decentralization to saveguard reliable and inalienable data

TRUST

Leveraging WEB3 to create and be the official issuer of certified evolutionary NFTs

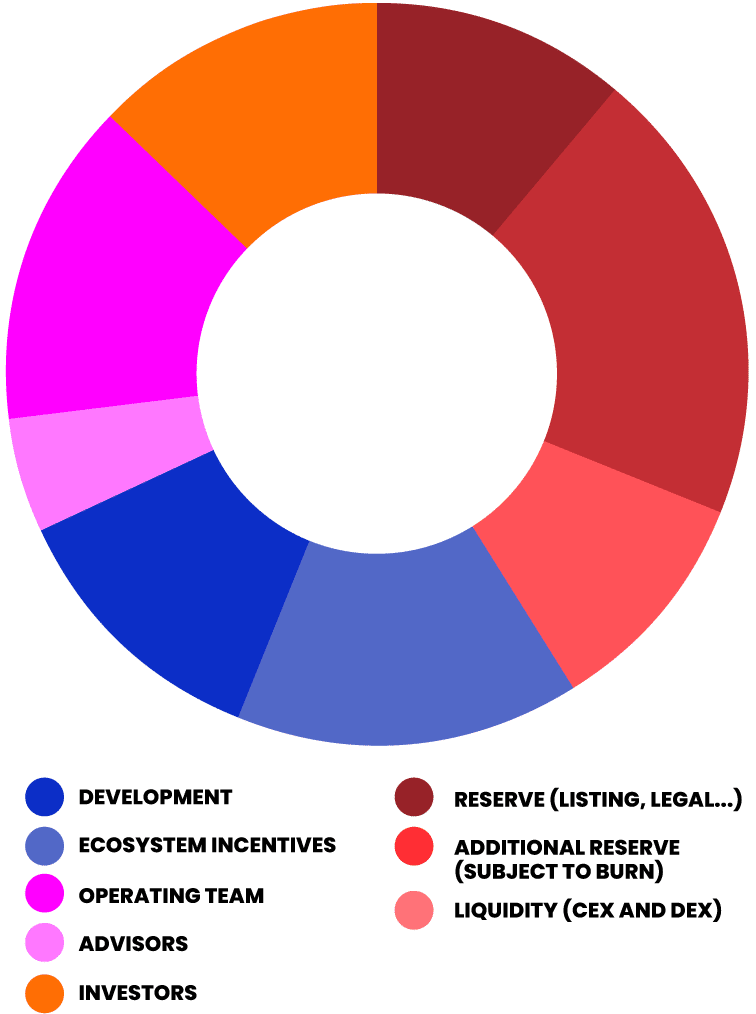

Token

Distribution

10,000,000,000 CDK token will be distributed

Development 12%

1,200,000,000 CDK

TOTAL INVESTORS 14%

1,300,000,000 CDK

Ecosystem Incentives 15%

1,500,000,000 CDK

Reserve 10%

1,100,000,000 CD

Operating Team 14%

1,400,000,000 CDK

Additional Reserve 20%

2,000,000,000 CDK

Advisors 5%

500,000,000 CDK

Liquidity 10%

1,000,000,000 CDK

Stake

your tokens

Until now, investors in Blockchain Projects at presale stages received only an agreement for future tokens (SAFT) in exchange of their payment.

Thanks to Charged Tokens (CT), investors can now have a clear state of their investment and also a more flexible position.

A CT is tied to a specific investment round with given vesting conditions set in the smart contracts (on the Blockchain) that can not be modified afterwards, providing more transparency and certainty to investors.

CTs are allocated to investors immediately after their payment and can be held to claim the underlying Project Tokens (PT) according to the vesting schedule set in the smart contract. But they can also be transferred/traded at any time, much before the Project even launches.

Staking CT allows users to get rewards from staking campaigns set by the Project Owner, and also from fees collected from previous CT withdrawals

Roadmap

Q4 2022

- Private Sale Round 2*

- Closing with private funds

- Partnerships in mobility announcements

- CDK Landing page

- Whitepaper V2

- In web tokens allocation

Q1 / Q2 / Q3 2023

- VC Fundraising

- In web staking pools

- App design facelift

- CodeNekt website facelift

- Driving data collection prototype

- AI driving algorithms testing

- Driving behaviour evaluation

- Carbon footprint algorithm testing

Q4 2023 / Q1 2024

- Fleet management software MVP

- POC with renown brands

- Exchange listing (DEX or CEX)

Meet our team

Francis HACHEM

CEO

Entrepreneur for 18 years in IT, including a company of 50 employees. Advisor for entrepreneurs and startups in recent years.

Andreas Swahn

CCO

Serial entrepreneur for 25 years. Founded, scaled and exited multiple companies inc: Aboyo, Smartster, EasyChange, Studentis, MegaPhone, EMDS.

JEROME TERMES

CTO ADVISOR

Philippe GIRARDIN

Fleet Management and Supply Chain Advisor

3P (People Planet Profit) transformation

Business architecture

Automotive with tires, bank, utilities and telecom market experiences

GHISLAIN MONCHARMONT

COO / CFO

Anne-Emmanuelle Nettersheim

CMO

Brand Designer for 10 years with BtoC brands. Specialization in digital and social communication

Mishael Stanley

TOKENOMICS ADVISOR

6 years experience in Blockchain and web3 (NFTs, DeFi, Metaverse). Advising native web3 projects on building sustainable tokens and game economies (P2E Modeling)

CHRISTOPHE TURCRY

AUTOMATIVE ADVISOR

15 years of experience in the automotive sector in industrial, design and marketing functions (PSA Peugeot Citroën)

FAQ

We want to become the leading certifier for mobility NFT tokenization by creating trust around tokenized vehicles, maintain data integrity, and insure vehicles traceability.

The CDK tokens will power the web3 side of CODENEKT and CDK NFTs will be used to store vehicles data throughout its life.

Codenekt aim to leverage blockchain technology and AI to bring visibility, trust and responsibility in mobility, insuring cars traceability, data integrity, and evaluating driving behaviours to improve drivers, road safety and reduce the overall carbon footprint.

It can be used by

- businesses fleets during their daily operation,

- families and users to insure road safety and evaluate user’s carbon footprint,

- cars manufacturers to tokenize vehicles before they go for sell,

- cars brands to maintain traceability of the cars history and its data once on the market,

- insurance companies using our drivers driving style certificate based on data and AI to offer tailor made offers and deals.

In the first usecase of MOBILITY, we estimate the potential market:

+ 2Bln Mobility users in the world

+1Bln Number of vehicles

in the world

+ 255MLN in Europe

The value of blockchain and tokenization are well established.

Most sectors are studying these new technologies very closely.

The NFT has found success in the art world but Its use to maintain traceability and represent ownership of assets is still in progress.

You can participate in our private round 2 selecting how much you wish to invest before we start listing the token at the end of 2023.

Our CDK Token is built on Algorand blockchain.

Why did we choose to create our token with the Algorand blockchain?

Our token project needs a blockchain:

- very fast (block <4.3 seconds)

- inexpensive (0.001 algo per transaction)

- compatible with our smartcontracts needs, scalable (expected increases in the number of transactions per second)

- development team available for support.